Black Friday Advice Marie Kondo-style

Faced with the shortest holiday buying season since 2013, retailers are barraging us with ads, emails and direct mail in an attempt to get us to shop early and often. The term Black Friday goes on all year long nowadays and has even been exported to Europe and Asia. According to Statista, consumers will spend a record $900-$1000 each during the holiday season with online sales projected to hit $143 billion.

Consider this information from Harris Group that found that 72 percent of millennials prefer to spend more money on experiences than on material things. Last time you Marie Kondo’d your closet I’d bet you hugged a sweater or hat or pair of gloves that you got as a gift and decided you don’t love it. The truth is that the day after turkey stuffing might as well be renamed “closet stuffing day.” In the age of experiences, downsizing, minimalism and eco-friendly lifestyles, we are about to do so much shopping that major shippers UPS, FedEx and USPS says they will move 865 million packages.

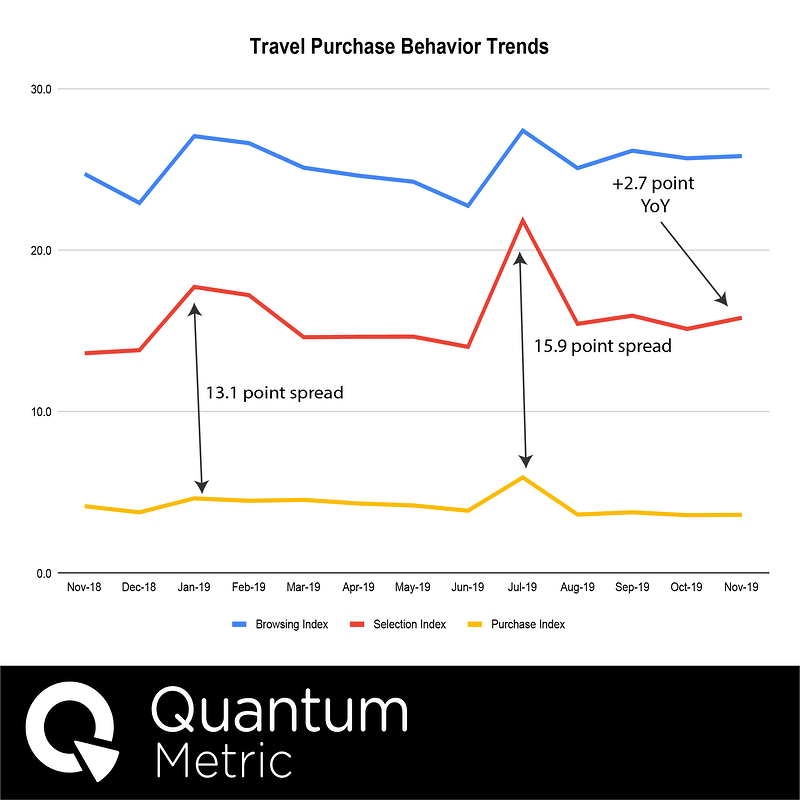

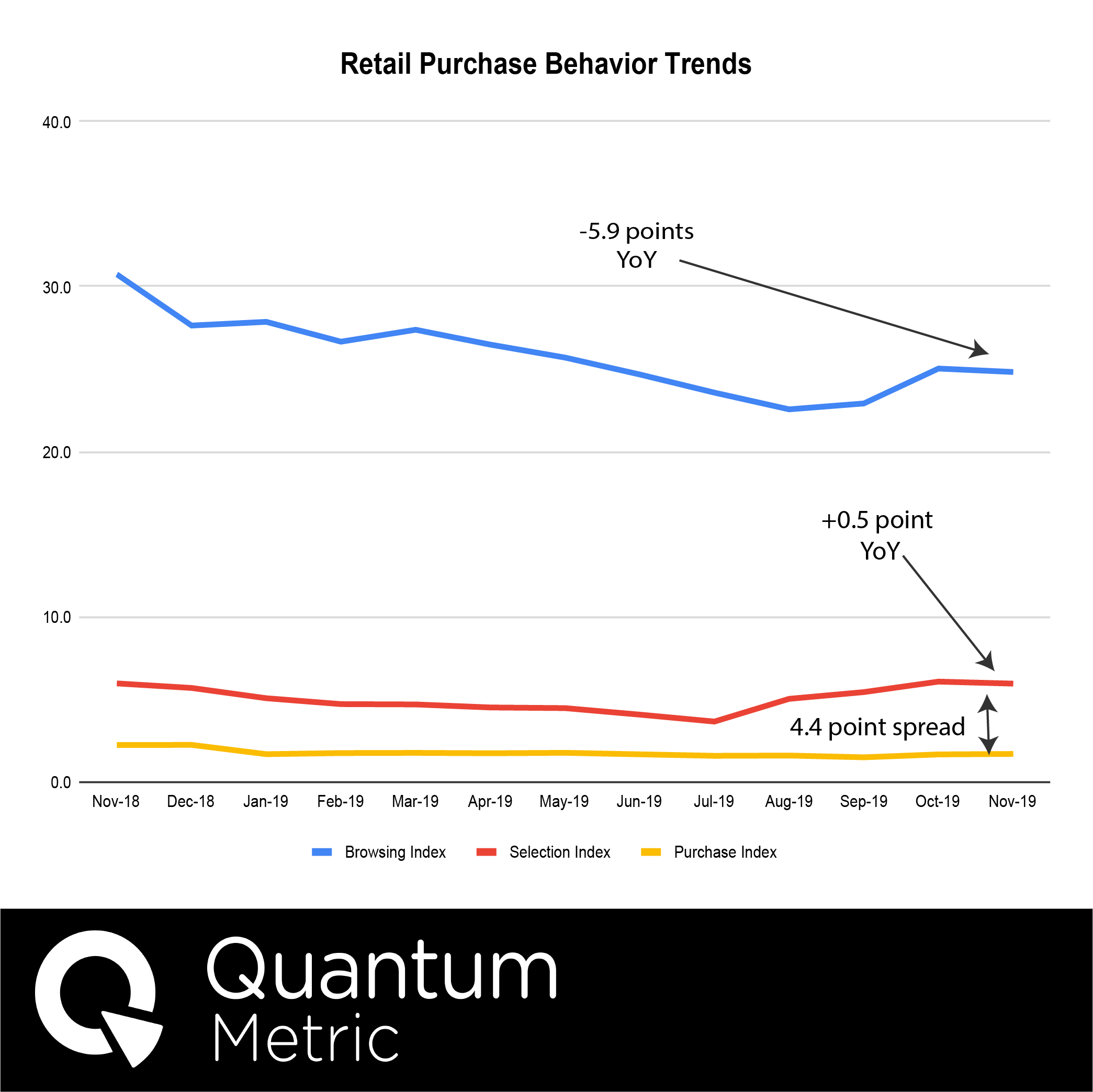

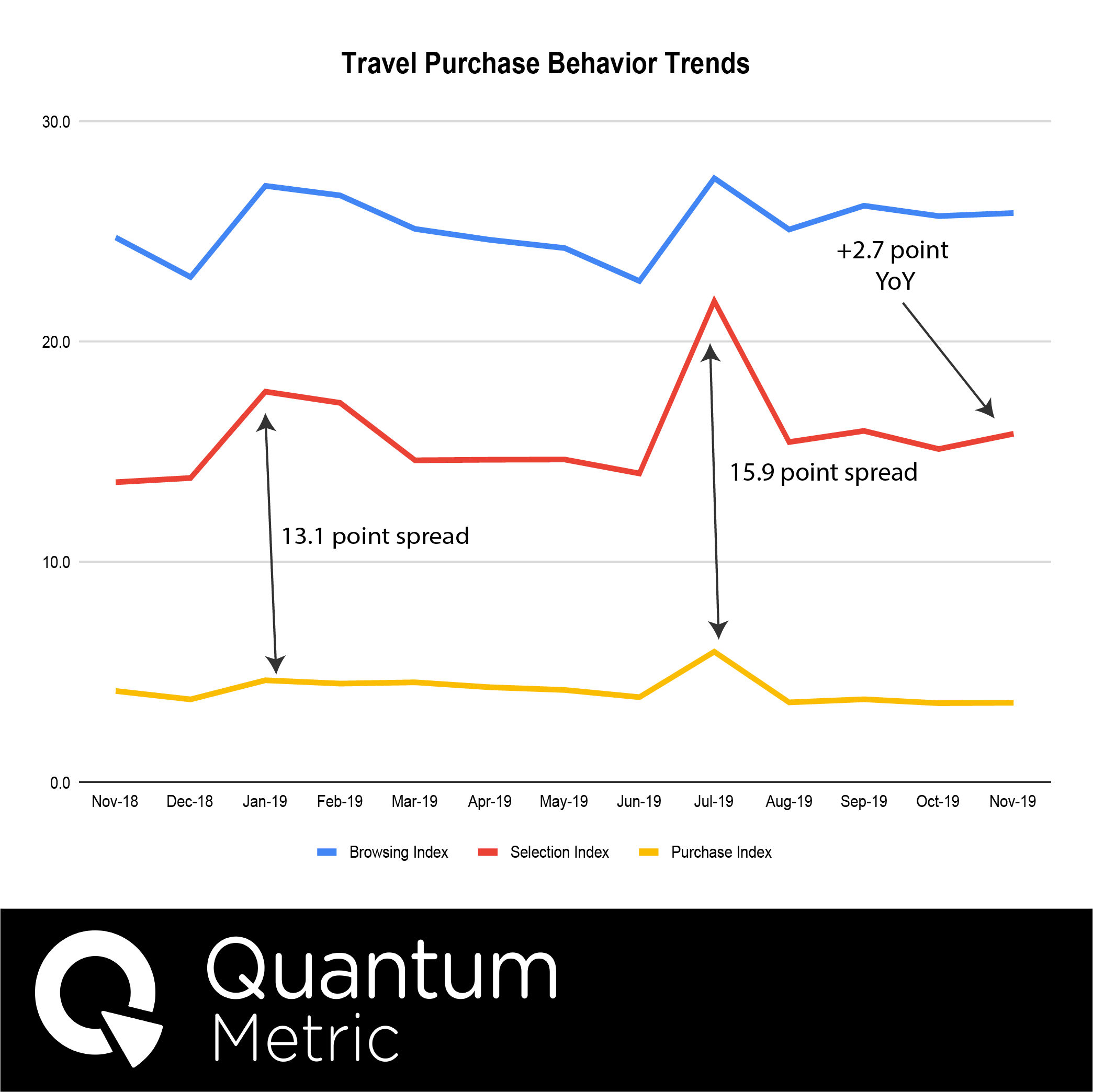

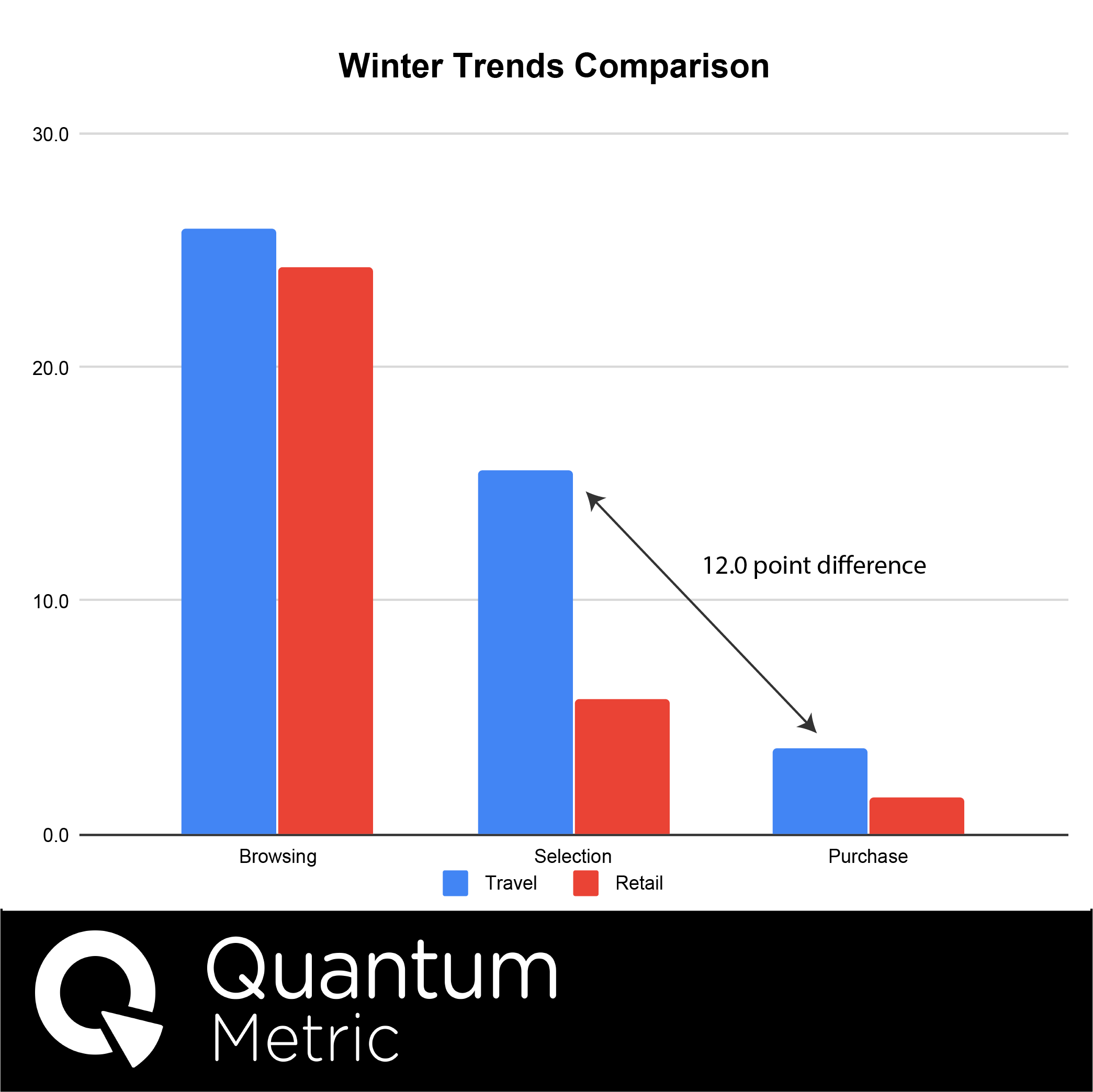

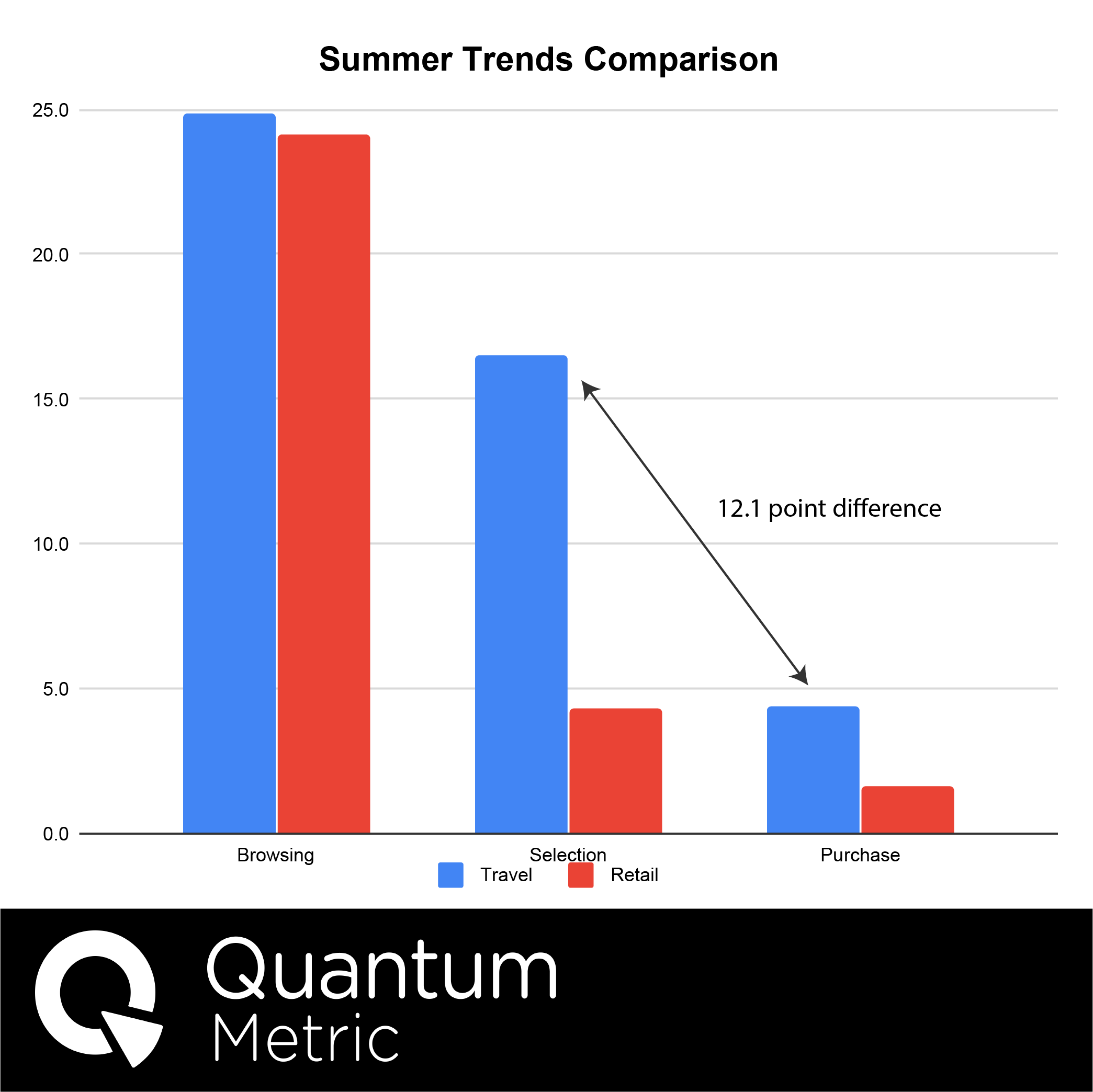

At Quantum Metric, we wanted to take a look at air travel to see if the data could prove the theory that airline ticket gifts could be the better choice during Cyber Week. For the analysis we grouped behavior into three categories: browsing, selecting, and purchasing, and compared monthly trends in retail versus air travel. ‘Browsing’ is the percentage of visits that result in active browsing behavior. ‘Selecting’ is the percentage of visits that result in a selection to the cart in retail or of a flight in air travel. ‘Purchase’ is the percentage of visits that result in a completed purchase where the retailer or airline achieved a final sale.

Retail shows a nearly 20% decline in browsing year-over-year (decline in the percentage of visits that actively browse). There is a large gap between browsing and adding to cart but a much smaller gap between the cart and the final purchase. Overall, the trend in the gap is fairly even but we are starting to see some signs that consumers are adding more items to the cart than last year.

Travel purchasing trend patterns are much more spiky with browsing and selection trends heading upward, while purchasing trends are slightly down. We find the spread between selecting and purchasing reaching an enormous 15.9 point spread in July to be particularly compelling.

Could the difference between retail and travel trends be based on the size of the purchase? We split out luxury retailers from the rest and found that all retail is consistent regardless of the Average Order Value. Could business travel be responsible for the differences? It is certainly a possibility, so we separated summer from winter trends because the impact of business travel is much less in the summer months.

The data shows very little difference in the gap between selecting and purchasing in the summer versus winter months for air travel which leads us to believe that business travelers do not skew the data.

After nerding out on data, you may be wondering what does this all mean? Well, travel has more browsing, selecting and purchasing overall which points toward the theory that consumer demand air travel more than retail goods. The big difference in selecting a flight versus adding to a shopping cart also points towards a strong preference to actively shop for tickets. Also, the huge drop off between selecting and purchasing can be attributed to consumer’s concerns about their ability to fit the trip within their budget or could also be a result of the poor “return” policy on purchased tickets.

With all the evidence that airline tickets make a better gift, why aren’t we receiving more travel gift cards? Ironically, the answer is a poor gift giver experience. It has never been all that special to receive a gift card and yet most experience-type gifts are only able to be given via cards. Another problem is the expense of the gifts. There are not many flights under $200 and most gift givers can’t afford to give an entire flight. Brands, like airlines, sitting in the catbird seat of the experience economy need to do more to turn their product into a great gift giving experience. Consider the possibilities for major airlines if they offered gift wrapped a collectable city bracelet charm, ornament or picture frame instead of an electronic receipt code. What if airlines offered travel registries which would enable multiple givers to contribute to a larger purchase? The travel industry is poised to disrupt Black Friday, but maybe not until next year.